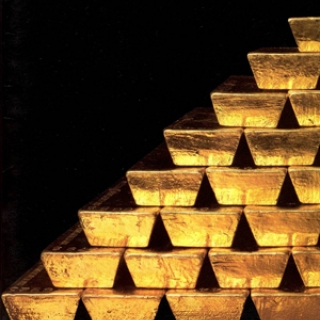

Gold prices hovered on Wednesday near their lowest point in more than one week, under pressure from a stronger U.S. dollar and rising Treasury yields, as fresh tariff threats from U.S. President Donald Trump unsettled markets.

Spot gold held its ground at $3,301.50 per ounce as of 0234 GMT. U.S. gold futures fell 0.2% to $3,310.10.

Trump said he would impose a 50% tariff on imported copper and introduce long-threatened levies on semiconductors and pharmaceuticals.

Trump reiterated his threat of 10% tariffs on BRICS nations on Tuesday, a day after notifying 14 countries, including Japan and South Korea, of tariff increases set to take effect on August 1.

The U.S. dollar index (.DXY), opens new tab steadied after nearing a two-week high late on Tuesday, while the yield on benchmark 10-year U.S. Treasury notes hovered near a three-week high.

"Gold prices are holding up impressively well this month against a backdrop of rising yields and a strengthening U.S. dollar ... its ability to resist the pressure suggests underlying strength and a bullish bias," said Ilya Spivak, head of global macro at Tastylive.

Higher yield increases the opportunity cost of holding non-yielding bullion, while a weaker dollar makes gold more affordable for holders of other currencies.

Investors will closely examine the U.S. Federal Reserve's latest meeting minutes, due later in the day, for hints of potential interest rate cuts amid the central bank's wait-and-see approach.

"It's a light week for economic data, but how prices react to minutes from June's FOMC meeting may help establish where we are in Fed vs. markets policy debate," Spivak said.

Meanwhile, Americans' inflation outlook remained stable, with the New York Fed's latest survey showing one-year inflation estimates at 3%, down from 3.2% in May, while the three- and five-year expectations stayed at 3% and 2.6%, respectively.

Spot silver fell 0.5% at $36.58 per ounce, platinum was down 0.8% at $1,348.78 and palladium lost 0.4% to $1,106.29.

Source: Reuters

Expectations that the Federal Reserve (The Fed) will cut interest rates have increased the appeal of gold, as yields on fixed-income assets (such as bonds) have become lower. The US dollar has weaken...

Gold rose on Friday (November 7) as expectations of further interest rate cuts from the Federal Reserve and lingering concerns over the US economic outlook amid the prolonged government shutdown boost...

Gold strengthened in the Asian session as signs of a fragile US economy emerged. US companies reported plans to cut more than 150,000 jobs last month—nearly triple the number in September—according to...

Gold (XAU/USD) edges lower on Thursday, after briefly reclaiming the key $4,000 psychological mark amid a weaker US Dollar (USD). At the time of writing, XAU/USD is trading around $3,985, easing from ...

Gold rose above the key $4,000 per oz level on Thursday (November 6th) as a weaker dollar and a prolonged US government shutdown raised concerns about the economic outlook. Spot gold prices rose 0.7%...

Crude prices recovered from a midday dip on Friday on hopes Hungary can use Russian crude oil as U.S. President Donald Trump met Hungary's Prime Minister Viktor Orban at the White House. Brent crude futures settled at $63.63 a barrel, up 25 cents...

US stocks rebounded from early losses to close mostly higher on Friday amid hopes that Congress members were making progress toward ending the government shutdown. The S&P 500 and the Dow Jones closed 0.3% higher, while the tech-heavy Nasdaq...

European stocks fell on Friday as investors digested more quarterly earnings, but weekly losses were inevitable, with concerns regarding overheated valuations evident. The DAX index in Germany dropped 0.8% and the CAC 40 in France declined 0.2%,...

Asian markets opened higher, following Wall Street's rebound. The Nikkei and Kospi jumped around 1% at the open, while US stock futures fluctuated...

Asian markets opened higher, following Wall Street's rebound. The Nikkei and Kospi jumped around 1% at the open, while US stock futures fluctuated...

The U.S. Supreme Court's tough questioning of President Donald Trump's global tariffs has fueled growing speculation that they will be overturned,...

The U.S. Supreme Court's tough questioning of President Donald Trump's global tariffs has fueled growing speculation that they will be overturned,...

European stocks closed slightly higher on Wednesday, tracking the rebound in North American equities as speculation on future AI returns continued...

European stocks closed slightly higher on Wednesday, tracking the rebound in North American equities as speculation on future AI returns continued...

European stocks opened lower on Thursday, as investors reacted to another flurry of corporate earnings.

The pan-European Stoxx 600 was 0.3% lower...

European stocks opened lower on Thursday, as investors reacted to another flurry of corporate earnings.

The pan-European Stoxx 600 was 0.3% lower...